کالکشن مُد روز

گوشواره دایره ای با قلب سفید

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

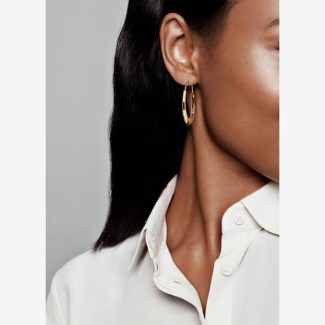

گوشواره طلا حلقه ای

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

گردنبند پرندگان بهشتی نقره

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

انگشتر برلیان کالسنا

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

دستبند طلا راه راه آبی

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

کالکش پاییز

گوشواره دایره ای با قلب سفید

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

گوشواره طلا حلقه ای

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

گردنبند پرندگان بهشتی نقره

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

انگشتر برلیان کالسنا

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

دستبند طلا راه راه آبی

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

محصولات ویژه

گوشواره دایره ای با قلب سفید

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

گوشواره طلا حلقه ای

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

گردنبند پرندگان بهشتی نقره

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

انگشتر برلیان کالسنا

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.

دستبند طلا راه راه آبی

لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است. چاپگرها و متون بلکه روزنامه و مجله در ستون و سطرآنچنان که لازم است.